Section 1 Guided Reading and Review Labor Market Trends Answers

- Original article

- Open Access

- Published:

Labor market policies and IMF advice in advanced economies during the Great Recession

IZA Journal of Labor Policy volume 3, Article number:2 (2014) Cite this article

-

10k Accesses

-

27 Citations

-

26 Altmetric

-

Metrics details

Abstract

In this paper we present and analyze the IMF's labor market recommendations for advanced economies since the beginning of the crisis, both in general and specifically in program countries. Our analysis is informed by our reading of the theoretical and empirical literature on the design of labor market policies and institutions in advanced economies. We organize our discussion around two concepts: micro flexibility, namely the ability of the economy to allow for the reallocation of workers to jobs needed to sustain growth; and macro flexibility, namely the ability of the economy to adjust to macroeconomic shocks. Achieving both types of flexibility while protecting workers and maintaining incentives for workers and firms to invest in existing relations, is not that simple, and the design of labor market institutions faces delicate trade-offs.

JEL codes

E2, J3, J5, J6

I. Introduction

In this paper we present and analyze the IMF's labor market recommendations for advanced economies since the beginning of the crisis, both in general and specifically in program countries. Our analysis is preceded and informed by our reading of the theoretical and empirical literature on the design of labor market policies and institutions in advanced economies.

The crisis has forced researchers and policymakers to reassess the functioning of markets, the design of policies, and the nature of optimal regulation. While the primary focus has rightly been on financial markets, the crisis has also raised questions about labor markets. Consider, for example, three of the issues in advanced economies that the IMF has had to confront in the past four years:

-

Between 2007 and 2010, the unemployment rate in advanced economies increased from 5.4 percent to 8.3 percent, and by the end of 2012 it had declined to only 8.0 percent. Assessing how much of this increase is cyclical and how much is structural is central to the design of policies, both on the demand side and on the supply side.

-

Adjustment in periphery euro area countries must come in large part from improvements in competitiveness within the common currency zone. Long-lasting improvements in productivity growth are clearly the right solution, but they will come slowly at best. The adjustment thus has to come initially in the form of relative decreases in nominal wages and prices. How can this be best achieved?

-

Many advanced economies entered the Great Recession with low potential growth and a high natural rate of unemployment. Higher growth and a lower natural rate would obviously be good on their own, but they may also be essential for the success of fiscal consolidation. Can labor market reforms help lower the natural rate? Can they make a substantial contribution to potential growth?

The purpose of this paper is to examine the positions the IMF has taken on these three issues, and on labor market policies, institutions, and reforms more generally, and assess to what extent these accord with what we see as the lessons of the literature.

We organize our discussion around two concepts: micro flexibility, namely the ability of the economy to allow for the reallocation of workers to jobs needed to sustain growth; and macro flexibility, namely the ability of the economy to adjust to macroeconomic shocks. Achieving both types of flexibility while protecting workers and maintaining incentives for workers and firms to invest in existing relations, is not that simple, and the design of labor market institutions faces delicate trade-offs.

These trade-offs, and how they are best managed, are the focus of the next two sections. We make no attempt at developing new theory or gathering new empirical evidence. In each case, our purpose is to summarize what we see as the main lessons from the (gigantic) literature and draw policy implications. Having done so, we return in the last section to the three issues listed in this introduction and discuss how the IMF has approached them1.

II. Micro flexibility

Increases in the standard of living come from productivity growth2. Productivity growth in turn requires the constant reallocation of resources. High-productivity firms must be able to enter, low-productivity firms must be forced to exit. More-efficient producers must grow faster than less-efficient ones3.

Good institutions are those that achieve this reallocation while limiting the welfare cost to workers who have to move. For product markets, competition is the key force behind reallocation and productivity growth. This means removing barriers to entry and, more generally, to competition. A proper bankruptcy framework is also needed to facilitate exit and encourage entry of new firms. For the financial sector, arm's-length finance and the availability of venture capital can facilitate entry of new competitors. For labor markets, "protect workers, not jobs" is, in this case, the right motto.

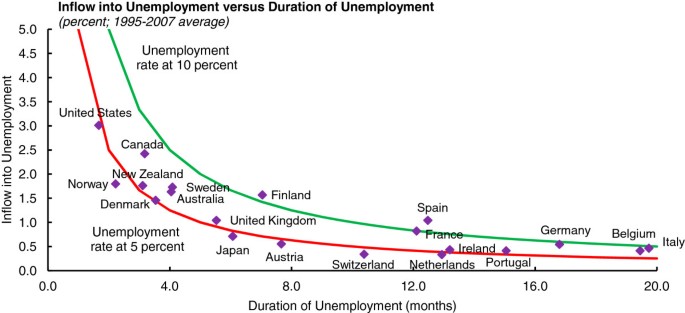

Some countries are worse than others at achieving this last goal. For many workers, the reallocation across jobs involves an intervening spell of unemployment. But the duration of unemployment varies widely across countries, for no obvious efficiency reasons. Indeed, some countries appear to do worse at both margins, with both lower flows and thus lower reallocation, and longer unemployment duration (Figure 1). For instance, for much of 1980s and 1990s, Portugal and the United States had similar unemployment rates, about 6½ percent. However, Portugal had low flows and high duration, and the U.S. had the reverse (Blanchard and Portugal, 2001). This suggests that Portugal had both worse reallocation (and likely lower productivity growth as a result, although the causal link is hard to pin down empirically) and larger welfare costs of unemployment.

Unemployment rate, inflows and duration. Source: International Labor Organization (ILO). Based on Perez and Yao (2012).

Full size image

A. Unemployment insurance and employment protection

In thinking about reallocation and unemployment, all labor market institutions obviously matter, but two play a central role: unemployment insurance and employment protection4.

The purpose of unemployment insurance is obviously to reduce the pain of unemployment. The purpose of employment protection is to decrease layoffs and thus reduce the incidence of unemployment.

Unemployment insurance

For many reasons, workers can neither fully self-insure against unemployment nor buy private unemployment insurance. Thus, unemployment insurance decreases the welfare cost of being unemployed.

It has long been recognized that provision of insurance may come at the cost of efficiency. Higher insurance leads to higher reservation wages and thus to potentially higher wages and lower employment. A higher reservation wage is also likely to lead to longer unemployment duration5. Longer search is not necessarily bad, as more time to search may lead to better matching, but it leads to the danger that some of the unemployed do not search, give up on search, or eventually become unemployable.

The large body of empirical evidence suggests that the insurance issue is highly relevant. But what matters more than the level of unemployment benefits is the precise design of the system—in particular, how benefits decrease with duration—and the quality of active labor market policies aimed at helping workers return to work6. In practice, implementing effective active labor market policies is difficult: job search assistance programs and training can be quite effective (in the medium term for the latter), but public sector employment programs are less so.

Employment protection

There is a trade-off between mobility and stability. Reallocation is important for productivity growth but much productivity growth also comes from stable employment relationships. Some employment protection is thus desirable and is indeed offered by firms that want their workers to invest in firm-specific skills. And some employment protection, in the form of a layoff tax, for example, is justified by the fact that firms should take into account the costs they impose on society, namely the unemployment benefits paid to the workers who are laid off.

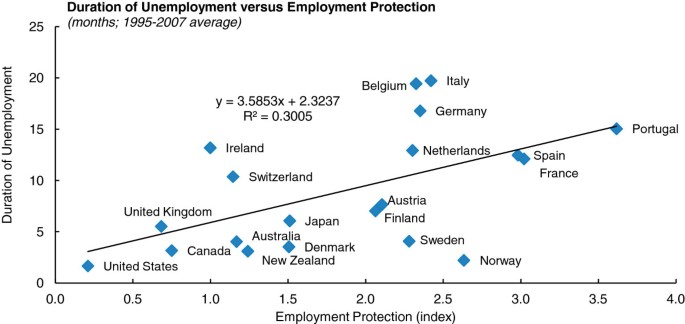

The problem is that employment protection is sometimes excessive or takes the form of complex legal and administrative restrictions on the separation process. It then hampers the reallocation process and is likely to decrease productivity growth7. But even the effect on workers' welfare is ambiguous. While employment protection decreases the risk of unemployment for those employed, it also decreases the ability of firms to adjust employment, thereby increasing their costs, even given wages. And because it reduces the risk of being laid off, employment protection reinforces the bargaining power of employed workers and hence may also increase wages. Higher costs lead to lower hirings and thus to higher unemployment duration. The effect of employment protection on unemployment duration indeed appears to be sizable (Figure 2). In short, fewer workers may be laid off, but those who are may face longer unemployment. The net effect on unemployment can go either way, but a given unemployment rate may hide lower reallocation and lower welfare.

Unemployment duration and employment protection. Source: Organisation for Economic Co-operation and Development (OECD) and International Labor Organization (ILO).

Full size image

The effect of employment protection on the probability of being hired is particularly strong for those workers whose productivity is a priori uncertain, such as new entrants or the long-term unemployed8. For this reason, as well as in response to firms' demands for more flexibility, reforms of employment protection have often introduced dual protection systems, with high employment protection on permanent contracts coexisting with lighter protection on temporary contracts. In many cases these reforms have had ambiguous effects, both on efficiency and on welfare. Constraints on renewing temporary contracts have led firms to invest little in their temporary workers. And temporary workers have suffered from a high level of employment insecurity, alternating between dead-end jobs and unemployment. While these contracts were initially limited to young workers, they have been spreading to older cohorts over time. Workers on temporary contracts may also suffer in other ways; for example, they often cannot obtain mortgages and their unstable careers put them more at risk of being excluded from the contributory pension system9.

B. Combinations?

An important branch of research has focused on the cross-country evidence regarding the effects of specific labor market institutions on the unemployment rate. (There has been less systematic research on the effects of those institutions on reallocation or their separate effects on unemployment incidence and unemployment duration). This research has reached two broad conclusions: The devil is in the details (and the details are hard to capture in the rough measures of institutions used in regressions); and the combination of institutions matters very much. At the risk of caricature, we might say that three labor market regimes have been identified—two of them relatively successful, the third one not10:

-

An "Anglo-Saxon" model—based on low employment protection and low unemployment insurance—which leads to large flows, short unemployment duration, and low unemployment.

-

A "Nordic" model—based on a medium to high degree of employment protection, on generous but conditional unemployment insurance, and on strong active labor market policies—which allows for reallocation while maintaining low unemployment11.

-

A "continental" model—based on high employment protection, generous unemployment insurance, and limited active labor market policies—which leads to limited reallocation and high unemployment12.

These are surely caricatures, but the success of the Nordic countries in "protecting workers, not jobs" has led to the belief that the Nordic model, also termed the "flexicurity model," is the direction to go to reform labor market institutions13.

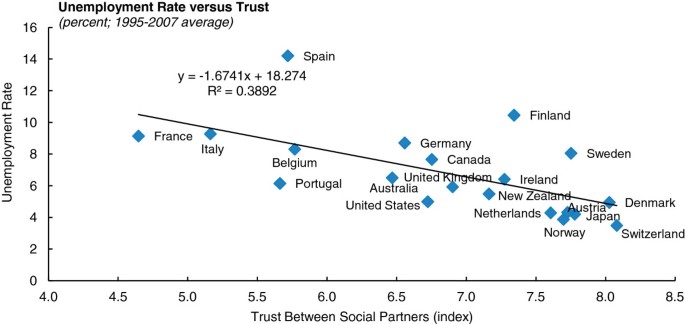

One main question, however, is whether the success of Nordic countries reflects underlying factors that may not be easily replicable. One of the striking results of the cross-country evidence is the explanatory power of variables capturing the degree of trust between firms and workers. Figure 3 shows the strong bivariate relation between such a trust measure (in this case, the answer to the question: "To what extent are industrial relations conducive to labor peace?") and unemployment across countries. The relation remains strong in multivariate regressions, and the introduction of a trust variable often reduces much of the estimated impact of the specific institutions (both in magnitude and significance)14. This suggests that the common denominator between successful countries is trust and that trusting partners can make widely differing combinations of institutions work well.

Unemployment and trust 1/. Source: Organisation for Economic Co-operation and Development and World Competitiveness Report. 1/Trust between firms and workers is measured by the extent to which industrial relations are perceived to be conducive to labor peace.

Full size image

This in turn raises two issues. The first is whether the relation is causal or whether good institutions lead to higher trust. While identification is difficult, the evidence suggests that it is indeed largely causal15. More generally, there is evidence that civic attitudes matter for both the design and the functioning of labor market institutions. For example, they appear to determine how much some of the unemployed abuse the unemployment benefit system. And the greater the abuse, the more likely is protection to be provided through employment protection, which imposes a larger efficiency cost.

The second issue is whether trust can be improved over time or whether low-trust countries are condemned to endure poorly functioning labor markets. The evidence is mixed. Differences in trust across countries are large and long lasting. But increases in trust do happen. It appears to have been the case in Ireland, where the measure of trust has substantially increased since the mid-1980s (although, interestingly, it has decreased somewhat since the beginning of the crisis). More research is needed to understand how trust is created. But clearly, dialogue and negotiation between representative social partners matters to reach shared commitments, and kept commitments increase trust16.

C. Tentative conclusions

There appear to be better and worse ways to organize trade-offs between efficiency and social protection. The existing research suggests to us the following:

Workers should be protected more through unemployment insurance rather than high employment protection (the flexicurity model). Unemployment insurance can be generous but only if it is coordinated with effective active labor market policies. Unemployment benefits should be conditional on reported job search, on training, and on job acceptance if acceptable jobs are available. A good vocational training system for adults coordinated with unemployment insurance is also essential. In practice, however, implementing effective active labor market policies is difficult and costly. The empirical evidence on the success of retraining programs is mixed; they have to be done right, and often they are not17.

There is a role for employment protection, but it should be limited, linked to the length of employment in the firm, and increasing continuously with tenure rather than with the threshold effects that characterize dual systems. Dual employment protection, where high employment protection on permanent contracts coexists with lighter regulation on temporary contracts, should be avoided. Judicial uncertainty should also be reduced. In many cases, judges can be called on by the workers to determine whether the layoff was for cause or not, and whether the cause was economic or not, with different implications for the amount of severance payments. Such great scope for judicial intervention potentially makes the process of layoff much more lengthy, costly, and uncertain18. There should be some judicial recourse, but employment protection should be more in the nature of a financial transaction than of a complex and uncertain bargaining process.

III. Macro flexibility

We think of macro flexibility as the ability of the economy to maintain a low unemployment rate in the face of macroeconomic shocks. This flexibility has two dimensions: a low average unemployment rate; and limited fluctuations in the unemployment rate in response to shocks.

As was the case for micro flexibility, all labor market institutions play a role in macro flexibility. For example, higher unemployment benefits lead to higher reservation wages, thus higher actual wages, and likely higher unemployment. By allowing variations in employment to adjust through the employment of temporary workers, dual employment protection systems isolate workers on permanent contracts—those workers who are likely to dominate bargaining—from labor market conditions. We focus here, however, on the three institutions that matter most: the minimum wage, the tax wedge (which affects primarily the average level of unemployment), and the collective bargaining structure (which affects not only the level but also the responsiveness of unemployment).

A. The minimum wage and the tax wedge

The minimum wage

The purpose of the minimum wage is obviously distributional, i.e., to make sure that low-skill workers receive a wage high enough to live on. It has led to a long debate about its welfare and efficiency effects. The standard argument is that a minimum wage may exclude low-skill workers from employment and therefore may have adverse effects on both welfare and efficiency. The empirical evidence suggests that, within a range, the effect on employment is small19. One potential interpretation is that, without a minimum wage, firms may be in a strong bargaining position and pay workers less than their marginal product; in this case, a wage floor may remove some of the firm's rents but still make it profitable for the firm to employ the workers.

While the minimum wage is an instrument of redistribution, there are limits to the extent to which it can be used as such. It can provide a floor that prevents exploitation, but more substantial redistribution is better achieved through a combination of a low minimum wage and a negative income tax. Indeed, the two are complements: In the absence of a wage floor, a negative income tax may simply decrease the pre-tax wage while having little effect on post-tax take home pay.

The tax wedge

The tax wedge—the difference between the cost of a worker to the firm and take home pay—is high in Europe. Many economists blame the tax wedge for higher unemployment, and indeed, it is a variable that is often significant in cross-country regressions of unemployment on labor market institutions20. The indictment is too broad, however. Some payroll taxes, such as retirement contributions, come with deferred benefits, and should, in principle, have little effect on the cost of labor to firms. Even for taxes without corresponding benefits, theory often predicts that the incidence should fall mostly on workers rather than on firms. To the extent, however, that minimum wages or unemployment insurance limit the decrease in wages, the tax wedge will increase the cost of labor to firms and thus increase unemployment. Shifting to other taxes may indeed be desirable.

The effects of the minimum wage and of tax wedges are primarily on the level of unemployment rather than on the fluctuations in unemployment; the structure of collective bargaining, however, affects both.

B. Collective bargaining

Effects on the level of unemployment

Theory makes ambiguous predictions about the effect of centralized collective bargaining on the level of unemployment. On the one hand, with centralized bargaining, worker representatives are more likely to put some weight on the welfare of the unemployed than they are under decentralized, firm-level bargaining. Other things equal, this should lead to lower unemployment. On the other hand, relative to firm-level bargaining, centralized bargaining increases the bargaining power of unions, which may lead to higher wages and thus higher unemployment.

Centralized bargaining has been blamed also for not allowing for regional disparities, such as productivity differences in the north and south of Italy. Similarly, it has been argued that globalization and economic integration shift the balance in favor of more decentralized wage setting which provides firms with more flexibility to adjust to increased competition. In theory, centralized bargaining is not inconsistent with regional or sectoral differentiation of wages. But if it does not recognize the need for such a differentiation, it may indeed be problematic. A similar issue may come from the equality of public sector wages we observe across regions in some countries. To the extent that workers have the choice between public and private employment, this equality of public sector wages can also limit regional differentiation of private wages.

Intermediate levels of bargaining, such as sectoral bargaining, have often been criticized on two grounds. The first is that, relative to centralized bargaining, they are likely to put less weight on the welfare of the unemployed. The second is that, relative to firm-level bargaining, they increase the bargaining power of the unions, with potentially adverse effects on employment. A commonly-advanced hypothesis is that the effect of the degree of centralization on unemployment is hump shaped, with either full centralization or full decentralization dominating intermediate levels of bargaining. The cross-country evidence, however, appears rather mixed21.

Extension agreements, which characterize sectoral bargaining, can play a useful role, especially where sectors are characterized by large numbers of small firms and establishments which cannot carry firm-level bargaining. Extension agreements also reduce incentives to undercutting of reasonable employment conditions. However, the effects of extension agreements depend on the quality of the bargaining process and the representativeness of social partners. At times, by allowing workers to benefit from bargaining outcomes even if they are not union members, they may decrease the representativeness, and by implication the legitimacy, of unions and, by so doing, decrease the quality of labor relations. This effect has been blamed, for example, for poor labor relations in France, where collective bargaining coverage is high but union membership is very low. Extension agreements should also provide enough flexibility when there is a wide dispersion of productivity between firms, by including top up agreements for the most profitable businesses or temporary opt-outs for firms requiring time to adjust as a result of adverse economic conditions.

Effects on the fluctuations of unemployment

Turning to the effects of the bargaining structure on the responsiveness of wages to unemployment, the first point to make is an important macro point, namely that not all macroeconomic shocks require an adjustment of wages. Decreases in internal demand, for example, can typically be offset through lower interest rates with internal and external balance reestablished at the same nominal and real wages. In some cases, decreases in wages may even have perverse effects. To take an example that is very relevant today, wage deflation can make things worse when the economy is in a liquidity trap: Higher deflation, combined with a zero nominal interest rate, implies a higher real interest rate and thus lower demand, lower output, and higher unemployment. But there are also cases where wages are too high and must decline, at least relative to (total factor) productivity, to decrease unemployment. This is the case for example when the price of nonlabor inputs, such as oil, increases dramatically, as happened with the oil shocks in the 1970s and early 1980s. Another example is a loss of competitiveness in a country that has either a fixed exchange rate or is part of a currency area—the problem facing many euro area periphery countries today.

In this case, theory suggests that centralized bargaining is likely to dominate firm-level bargaining, for two reasons: because it is likely to give more weight to the welfare of the unemployed than is firm-level bargaining; and because it can solve a coordination problem. When wages are negotiated at the firm level, a decrease in the wage at a given firm is a decrease in the relative wage, something that workers will be reluctant to accept. The process of adjustment in which all wages and, in turn, prices adjust is likely to be protracted. When wages are negotiated at the centralized level, wages can be adjusted at once and across the board without changes in relative wages. And firms can commit to passing decreases in costs into prices, so the decrease in the real wage is smaller than the decrease in the nominal wage.

C. Tentative conclusions

One has to be especially careful when discussing reforms of collective bargaining structure. These institutions are deeply rooted in countries' history and underlying social norms. Moreover, the empirical evidence on their impact on labor market performance is scant, and more research is crucially needed given the importance of the issue. Nevertheless, our review of the economic arguments suggests that what is needed for efficiency is a system that allows decentralized wage setting (adaptation "across space", i.e., sectors, regions, firms) while keeping coordination to help the macroeconomic adjustment. Conceptually, a combination of national and firm-level bargaining seems attractive. Firm-level agreements can adjust wages to the specific conditions faced by firms. National agreements can set floors and, when needed, help the adjustment of wages and prices in response to major macroeconomic shocks. Historical examples are the Wassenaar Agreement in the Netherlands in 1982 and the Moncloa Pact in Spain in 1977, which are both credited with dramatic improvements in labor markets in difficult circumstances22. Such agreements can indeed greatly improve the adjustment. However, efficient forms of coordination of sectoral bargaining can also be found, e.g. wage leadership of the tradable sector in Germany23. This bargaining structure may be especially useful when there is large proportion of small firms for which firm-level bargaining is difficult and costly. Our reading of the research and the evidence on this topic again suggests that the devil is in the details and that, to succeed, trust is needed more than any particular bargaining structure. And trust may not be present: Workers may not trust firms to reflect wage adjustments into their prices, and it may be difficult for firms to commit to such price adjustments ex ante.

IV. IMF recommendations during the Great Recession

Returning to the three labor market issues in advanced economies listed in the introduction—the cyclical versus structural character of higher unemployment, the need for improvements in competitiveness in the euro area periphery, and the potential for labor market adjustments to lower the natural rate of unemployment and improve growth—what did the IMF recommend, and did these recommendations fit the conclusions we have derived above24?

A. Unemployment

The Great Recession led to a sharp increase in the unemployment rate, and unemployment has remained high to this day25. There is little question that the initial increase was due to a sharp decrease in aggregate demand, and hence to an increase in cyclical unemployment rather than in the natural rate of unemployment. Over time, however, the proportions have become more uncertain. Some researchers and policymakers have argued that, in a number of advanced economies, output is close to potential and unemployment is close to a higher natural rate, and thus they advocate for a policy focus on the supply side. One argument in support of that view is that, if indeed the unemployment gap is large, inflation should be sharply decreasing; the fact that it is not implies that the gap is small.

The IMF has taken the view that high unemployment was and remains largely cyclical, that in most countries there is still a substantial unemployment gap, and that policies that sustain aggregate demand are still of the essence26. The assessment that the natural rate has not increased much is based in particular on the relative stability of the Beveridge curve—the relation between unemployment and vacancies. Were there a large increase in the natural rate, it would show up as a rightward shift in the Beveridge curve, that is, as an increase in unemployment given vacancies. There is little evidence that this is the case. Other measures of mismatch increased at the onset of the recession but returned to normal levels fairly soon27. While the behavior of inflation remains indeed somewhat puzzling, the lack of deflation appears to come largely from a strong anchoring of inflation expectations and a decrease in the effect of the unemployment gap on inflation rather than from a small unemployment gap28.

This interpretation led the IMF to recommend a strong fiscal stimulus early in the crisis. The assessment was that there was a high risk of a collapse of demand, and that given the zero bound on monetary policy, fiscal stimulus was the only instrument readily available. While we shall never know the counterfactual, we believe that the fiscal expansion prevented a much worse decrease in demand than actually took place.

Once the collapse was averted, the increase in debt—seen not so much as due to the fiscal stimulus but rather to the large decrease in output and thus in government revenues—led the IMF to recommend a shift from fiscal stimulus to fiscal consolidation. Further fiscal expansion would have made the debt unsustainable, leading eventually to sovereign default. The IMF emphasized that, while needed, consolidation would have adverse effects on demand, especially in a context of simultaneous deleveraging in many sectors (household, financial, government) and many countries. Hence, the fiscal consolidation should proceed gradually where financing conditions permitted, relying on credible and detailed medium-term consolidation plans to anchor expectations. The effects of consolidation should be offset as much as possible by other measures to sustain growth, from unconventional monetary policy to improvements of financial intermediation to, in some cases, an improvement in the trade balance29. This still appears to be the only path to recovery.

Although demand policies have been the primary focus in the advanced economies, other policies have been aimed at decreasing the incidence and the pain of lower labor demand. Particularly striking has been the experience of Germany, where the extensive use of short-time work helped prevent a sizable increase in unemployment early in the crisis. Whether this experience can be replicated elsewhere, and how to ensure that the programs are eventually phased out to prevent their coming in the way of reallocation, are open issues. But it has clearly led to a reassessment of such policies at the IMF and elsewhere30.

With lasting high unemployment in most countries, however, unemployment duration has steadily increased. One argument against longer unemployment benefits, namely that they decrease search intensity, is weaker in a severe recession: When vacancies are scarce relative to the pool of unemployed workers, any job not taken up by one worker (because of provision of unemployment benefits) is quickly filled by another. In its policy advice, the IMF has generally supported the extension of unemployment benefits, for instance in the United States. In the Iceland program, spending on the unemployed quadrupled during 2008–10, mostly because of additional unemployment benefits. Under the Greece program, unemployment insurance benefits are being expanded, initially on a pilot basis. But the IMF has also supported a reduction in benefits where they were judged to be so generous that they significantly lowered incentives for reemployment. This was the case in Portugal, where the unemployment insurance system was one of the most generous in the EU31.

A prolonged period of unemployment, even if cyclical in nature, risks increasing the natural rate itself—the so-called hysteresis hypothesis. The length of the crisis and the protracted weak recovery increase the risk of the unemployed losing skills and getting discouraged, turning the cyclical increase in unemployment into an increase in the natural rate. Three groups of workers—the young, the low-skilled, and the long-term unemployed—need more-targeted intervention when demand and employment prospects are depressed, and even when things start to recover: (1) the young because starting their working lives in a depressed economy can jeopardize their long-term career paths and earning prospects; (2) low-skilled workers because demand for their services may be in secular decline, and even a recovery may not bring about an improvement in their prospects; (3) and the long-term unemployed because loss of hope and skills may make them permanent castaways from the labor force. In Iceland, program measures targeted at such groups included expanding registration for unemployment benefits, job retraining, subsidized hiring, and study programs. In 2011, the availability of education was improved by opening secondary schools to anyone below 25 years of age and promoting work-related education.

The very unequal distribution of unemployment and its unusual concentration among the youth in some countries in part reflects dysfunctional labor market institutions, namely the dual employment protection systems we discussed earlier. In a number of countries, particularly Italy, Portugal, and Spain, the IMF's recommendation has been to reduce duality. This will not change things overnight; the large-scale destruction of jobs has already happened in some of these countries. A smooth transition, as well as grandfathering existing contracts, may well make sense: Lowering employment protection on existing contracts at this point would likely add to unemployment, though it may also facilitate the necessary process of economic restructuring. Reducing employment protection on new permanent contracts, where it is excessive, can help stimulate the hiring of the unemployed on more stable contracts as the recovery takes hold.

B. Competitiveness

In most countries, we argued above, macroeconomic policies should be the primary tools to support employment, complemented by various micro policies to better share the burden of unemployment. In a number of euro area countries, however, current account deficits were very large before the crisis, and the recovery must come in large part from improvements in competitiveness at a fixed nominal exchange rate.

To become more competitive, a country has only two options: cut relative wages or become more productive. Improvements in productivity growth are clearly the more attractive channel, but reforms to raise productivity often involve changes in regulation and behavior that take time to show their effects. Until those effects do take hold, the only remaining option is to reduce relative wages: through currency depreciation in countries with flexible exchange rates, and by explicitly cutting relative nominal wages and prices in countries within a common currency area.

Shifting relative inflation rates

By definition, reversing the competitiveness gap in the euro area implies accepting higher inflation in the North of the currency union than in the South. For example, to meet the 2 percent inflation target at the euro area level, inflation must be lower than the target in the South and higher than the target in the North. Thus, if it wants the South to adjust, the North must accept more inflation, a point that has been emphasized by the IMF but has not been always fully understood.

National wage-cut agreements and the role of trust

Clearly the best way for periphery countries to achieve wage reductions is by common assent, such as through a national tripartite agreement among social partners. The problem, in general, is that workers may not believe that a wage cut is needed. Even if they do, they have to be willing to trust that price declines will follow. The commitment on the part of firms to cut prices if costs decrease is hard to verify and thus hard to enforce.

The IMF recommended such agreements, informally or formally, in a number of euro area countries, but they were difficult to achieve or did not take place.

-

In Ireland, despite a tradition of tripartite agreements from the 1980s on, discussions turned contentious when conditions turned sour. The government undertook unilateral actions on pay and pension cuts before an agreement with unions was reached again in 2010.

-

In Spain, with inflation falling at the start of 2009 and the economic climate deteriorating, social partners were unable to reach a national wage agreement for 2009. However, in February 2010, a new three-year agreement was signed that limited wage increases and postponed indexation.

-

In Greece, with poor labor relations, no deal could be struck. In fact, real wages in 2009—which incorporated inflation expectations that turned out to be too high—increased. This increased household incomes; but with wage growth outstripping the euro average, competitiveness further suffered.

In the absence of national agreements, what (unattractive) choices are available?

Greater flexibility in wage-setting

More flexible wage-setting allows firms and their workers to set wages to levels that reflect firm-level productivity and restore competitiveness. In periphery countries that had intermediate levels of bargaining (Greece, Portugal, and Spain), the IMF's advice was to facilitate opt-out clauses from collective agreements and move toward decentralization of collective bargaining to the firm level where intermediate level bargaining was not delivering a sufficient adjustment.

Decreasing public sector wages

Such decreases help the fiscal situation, but they can also potentially affect private sector wages and thus improve competitiveness. Whether such a strategy is justified depends on whether public sector wages are initially too high relative to private sector wages and on the degree of pass-through from public to private sector wages, which are the wages which matter for competitiveness. In Latvia, some of the adjustment came via a sharp reduction in public sector wages and thus a direct improvement in the fiscal position. Together with high unemployment, lower public sector wages put pressure on private sector wages to adjust, though by how much is a matter of some disagreement. In Serbia, there was a freeze on public sector wages in 2009–10—but with relief payments for those with lower incomes—to bring them more in line with private sector wages.

Decreasing the minimum wage

Decreasing the minimum wage can be quite effective, as many wages move with the minimum wage (especially when the wage distribution is compressed); but it is justified only when the minimum wage is clearly out of line. As we argued earlier, the minimum wage should be thought of as a floor rather than as the main instrument of redistribution. This view led the IMF to recommend cutting the minimum wage in Greece (to bring it back toward 40 percent of the median wage) and a freeze of the minimum wage in Portugal after rapid increases during 2007–10 (in this case the level of the minimum wage was not too far out of line with the EU average)32.

Fiscal devaluations through a shift in taxes

A potential way of increasing competitiveness that received a lot of attention is to decrease direct taxes and increase the VAT, a so-called "fiscal devaluation." The basic idea is that with nominal wages fixed in the short run, lower labor costs from a cut, say, in social contributions will reduce export prices. The increase in the VAT will not bear on exports and hence will not dampen this effect. Hence the tax shift can accelerate the adjustment in the current account. This strategy is not a panacea, however: One can achieve, at most, a couple of percentage points of devaluation, since large changes in social contributions and the VAT would not be feasible. The IMF supported the idea of a fiscal devaluation in a number of countries, including France, Italy, and Portugal. In any event, despite much discussion of the option, fiscal devaluations have not thus far been implemented during this crisis33.

C. Growth in the medium term

Advanced economies in general, and a number of European countries in particular, suffer from very low potential growth. Some also suffer from a high natural rate of unemployment. A lower natural rate and higher potential growth are desirable on their own. But they would also facilitate the difficult fiscal adjustment many countries face; and in the countries that need to improve their competitiveness, they would allow a smaller adjustment in relative wages. A lower natural rate and higher potential growth, however, are unlikely to come on their own; they require structural reforms in product and labor markets.

Product market reforms

Structural reform in product markets—particularly lowering barriers to entry of new firms—is likely to produce a larger growth payoff than reform in labor markets. By making entry of new firms possible, lowered barriers to entry curb the market power and rents of incumbents and thus expand activity levels and labor demand over the medium term. A number of empirical studies find evidence that product market reforms lead to an increase in total factor productivity over the medium term and a decline in the average rate of unemployment34.

In the short term, however, increased competition is likely to result in shedding labor in some sectors and even a decrease in employment for the economy as a whole. Put another way, unless the resulting productivity increases are matched by at least a proportional increase in aggregate demand, employment will decrease. This is a particularly relevant issue in the current context, in which macroeconomic policy tools to increase demand are limited, and unemployment is already very high.

Moreover, the largest potential improvements in productivity are typically in the nontradables sector, where demand is relatively inelastic, so an increase in productivity there is likely to decrease employment in the short run. In the tradables sector, where the demand is more elastic, increases in productivity are more likely to lead to an increase in employment; but because firms in this sector face greater competition in the first place, there is typically less room for large productivity gains.

For these reasons, the IMF has cautioned that while product market reforms are essential to the recovery, they may have adverse short-term employment effects and should, at this juncture, be chosen carefully35.

Labor market reforms

Labor market reforms can lower the natural rate of unemployment; modify its incidence on particular groups; and, by improving reallocation, increase productivity growth. In earlier sections we indicated a number of labor market reforms that both theory and empirical evidence suggest can indeed help.

Such evidence led the IMF to recommend a number of institutional changes without which it believed the needed increases in growth may not be forthcoming.

We have already mentioned the reform of employment protection to reduce duality. Such a reform may not affect the unemployment rate very much, but it can help avoid the very high unemployment rates among particular groups, such as new entrants, in a number of countries.

The IMF has also made recommendations aimed at increasing participation and employment rates. In many countries, the average age of the population is rising, and people over 55 make up an increasing share of workers. The aging of societies poses challenges for the sustainability of welfare regimes, particularly pension systems, if participation rates do not keep up as well.

While countries may well want to differ in the participation rates of various groups, some of the differences across countries appear to come from distortions. Removing these distortions to increase participation is desirable, not only for its own sake, but also because it again helps fiscally, for example by making it easier to finance retirement systems.

The rise in average labor force participation rates over the past two decades largely reflects the entry of women into the labor force36. Nevertheless, with average female participation rates nearly 20 percentage points lower than those for men, there is great scope for further increase. The IMF has recommended reducing the secondary-earner tax wedge―that is, the tax wedge applying to the spouse with the lower income in two-earner couples―in countries that currently apply family taxation, such as France and the United States. In other countries, lower marginal tax rates or targeted in-work tax credits for secondary earners can help reduce distortions. The IMF has also recommended that high and unconditional income support to families could be replaced with programs that give higher benefits to those in work, such as childcare subsidies for working mothers (which are relatively low in Austria and Portugal).

Another group for which labor force participation could be raised is workers aged 55 and older. Here the needed reforms include increasing effective retirement ages. The IMF has recommended raising statutory retirement ages where they are particularly low (France, Greece) and adjusting pension benefits in several countries to actuarially fair levels. Tougher rules governing disability benefits would also help. Participation in disability benefit programs is quite high, exceeding 10 percent of the labor force in a few countries. Linking disability benefits to work capacity and strengthening the attachment of disability claimants to the labor force through active labor market policies could help in Greece, Ireland, and Portugal. Under Romania's program, the pension law increased the retirement age, re-indexed pensions, and tightened conditions for early retirement and disability pensions. The changes started in 2011 and are being implemented gradually. The minimum pension thresholds were left unchanged to protect the poorest pensioners.

V. Conclusion

We have argued that economies need "micro" flexibility—the ability to reallocate resources to generate productivity growth—as well as "macro" flexibility—the ability to adjust to macroeconomic shocks. Designing labor market institutions so that they enhance flexibility while protecting workers is a difficult task. Nevertheless, our review of the literature and evidence provides some tentative conclusions on how this can be done.

To have micro flexibility, workers should be protected more through unemployment insurance rather than high employment protection (the so-called "flexicurity" model). Employment protection plays a role in creating incentives for workers and firms to invest in existing relations, but it should not be excessive. Dual employment protection, that is, giving permanent workers a lot of protection and temporary workers little protection, should be avoided.

Macro flexibility depends critically on the collective bargaining structure. What is needed for efficiency is a system that allows decentralized wage setting while keeping coordination to help the macroeconomic adjustment. A combination of national and firm-level bargaining seems like an attractive solution to the needs for both flexibility and coordination. Firm-level agreements can adjust wages to the specific conditions faced by firms. National agreements can set floors and, when needed, help the adjustment of wages and prices in response to major macroeconomic shocks. This being said, the implications of alternative structures of collective bargaining are poorly understood. This suggests that the IMF should tread carefully in its policy advice in this area, particularly since governments may have limited ability to reform existing systems. Moreover, trust among social partners appears to be just as important in bringing about macro flexibility as the structure of collective bargaining.

We have then looked at the labor market recommendations of the IMF since the beginning of the crisis, both in general and in program countries in the light of these conclusions. Given the assessment that much of the increase in unemployment is cyclical, IMF advice has been to maintain aggregate demand to the extent possible and to share the pain of lower demand through extension of unemployment insurance benefits. In countries that need to improve competitiveness, but also want to belong to a currency union or maintain a currency peg, the choices have been more difficult. Greater flexibility in wage-setting (for instance through opt-out clauses from collective agreements) and public sector wage cuts have been part of the adjustment process in IMF-supported programs in these countries. Some of these recommendations have been controversial, but we have done our best to explain their logic. A natural next step, which we leave for future work, is to assess whether IMF advice was followed and if so, proved helpful.

Endnotes

1In thinking about labor market institutions, two different visions are relevant and essential to keep in mind. The first focuses on external labor markets, as captured for example in the flow/matching models developed by Diamond, Mortensen, and Pissarides. Those models focus on the large flows of workers and the process of reallocation across firms (Diamond, 1982a,1982b; Mortensen and Pissarides, 1994; and Pissarides, 2000). The other focuses on internal labor markets and emphasizes instead the long-lasting relations between firms and workers (for example Doeringer and Piore, 1971; and Akerlof and Yellen, 1987).

2How productivity growth is distributed matters a lot if increases in living standards are to be broadly shared. The increase in wage inequality in many advanced economies is indeed an increasingly important issue. But while labor market institutions play a role in this context, many other important drivers, such as globalization and biased technological progress, lay largely outside the labor market. To limit the size of this paper, we leave aside the issues associated with inequality and the role of labor institutions in that context.

3Evidence on the role played by resource reallocation in promoting productivity growth is reviewed in Martin and Scarpetta (2012) and Syverson (2011). From the workers' side, indirect evidence also stems from the fact that voluntary job changes are typically associated with significant positive wage premia (Organisation for Economic Cooperation and Development (OECD) 2010).

4Blanchard and Tirole (2004) discuss the optimal joint design of unemployment benefits and employment protection.

5Whether countries end up with high unemployment insurance and high duration of unemployment or low insurance and low duration is partly a matter of social choice. In general, there is a trade-off between welfare and efficiency. Countries should clearly avoid "interior" solutions where they are giving up both efficiency and welfare. But once they are on the welfare/efficiency frontier, social choice determines what point they pick on the frontier.

6Evidence on the effect of unemployment benefits and active labor market policies on unemployment is discussed in Organisation for Economic Cooperation and Development (OECD) (2006) and Card, Kluve and Weber (2010); effects on productivity—through better matching and encouraging firms and workers to go into high-risk, high-productivity jobs—are discussed in Organisation for Economic Cooperation and Development (OECD) (2007). The evidence on the impact of unemployment benefits on flows of workers or jobs is mixed (see, for instance, Gómez-Salvador, Messina, and Vallanti, 2004; Boeri and Garibaldi, 2009; and Organisation for Economic Cooperation and Development (OECD) 2010).

7Evidence on the effect of employment protection on labor reallocation is reviewed in Organisation for Economic Cooperation and Development (OECD) (2010), Betcherman (2012), and Martin and Scarpetta (2012); effects on productivity growth are discussed in Organisation for Economic Cooperation and Development (OECD) (2007), Betcherman (2012), and Martin and Scarpetta (2012). Bassanini, Nunziata, and Venn (2009) find that mandatory dismissal regulations depress total factor productivity growth in industries where layoff restrictions are more likely to be binding, translating into a small negative effect on aggregate labor productivity growth. The difficulty in teasing out the effect on productivity growth could reflect the fact that firms adjust to high employment protection through capital and skill deepening and/or the fact that longer expected tenure leads to more training of workers. The evidence on the impact of employment protection on the unemployment rate is reviewed in Organisation for Economic Cooperation and Development (OECD) (2006) and Betcherman (2012).

8Evidence on the negative effect of employment protection on the employment of these subgroups is discussed in Bertola, Blau, and Kahn (2007); Betcherman (2012); Jimeno and Rodríguez-Palenzuela (2002); and Organisation for Economic Cooperation and Development (OECD) (20042006). For a discussion of dual employment protection, see Bentolila and Dolado (1994); Blanchard and Landier (2002); Cahuc and Postel-Vinay (2002); and Dolado et al. (2002).

9See Boeri (2011) for a survey of dual labor markets.

10See for example Organisation for Economic Cooperation and Development (OECD) (2006); and Bertola, Boeri, and Nicoletti (2001).

11The two models also differ in another way: the Anglo-Saxon model is associated with substantially more inequality than the Nordic model.

12These labels are broad characterizations and there are exceptions in the regional groupings. For instance, Germany has moved away from the continental model and toward the Nordic model by implementing the so-called Hartz reforms. These aim at improving the efficiency of active labor market policies, reforming the benefit system to activate the unemployed, and to some extent deregulating the labor market.

13To anticipate the discussion in the next section, the models also differ in their collective bargaining structures. The "Nordic" model has centralized collective bargaining and high union density.

14See for instance Blanchard and Philippon (2006).

15The concept of trust and its role in determining unemployment is discussed in Blanchard and Philippon (2006). They use strike activity in the early 1960s and historical evidence from the 19thcentury on the attitude of states towards early unions to construct instruments for current labor relations and establish causality. Algan and Cahuc (2009) discuss the role of civic attitudes in the design of labor market institutions.

16Aghion, Algan and Cahuc (2011) find that state regulation of labor markets and the quality of labor relations are negatively correlated. They argue that state regulation can reduce the possibility for workers to experiment negotiation and learn about the potentially cooperative nature of labor relations. In turn, distrustful labor relations can lead to low union density and high demand for state regulation.

17Organisation for Economic Cooperation and Development (OECD) (2006) notes that microeconomic evaluation studies of different active labor market policies suggest that details of program design are key. Low-cost assistance with job search works well, while public job creation does not help much in bringing the unemployed back to unsubsidized work. Policies that are found to be the most effective are intensive employment services, individual case management, and selective referrals to long-term training programs.

18Ichino (2012) describes how the judicial system is key to a (mal)functioning labor market. The general principle should be that economic decisions should be left to the firm, and the role of judges should be limited to assessing whether dismissals are fair or unfair. Reforms in that direction have proven difficult.

19Evidence on the effect of the minimum wage on unemployment is discussed in Organisation for Economic Cooperation and Development (OECD) (2006), Betcherman (2012), and Schmitt (2013). The minimum wage also plays a role through its effect on other wages; this is relevant for macro flexibility.

20See Organisation for Economic Cooperation and Development (OECD) (2006) for a review of the empirical evidence.

21See Calmfors and Driffill (1988); Scarpetta (1996); and Elmeskov, Martin, and Scarpetta (1998). For surveys, see Flanagan (1999), Organisation for Economic Cooperation and Development (OECD) (2006), Betcherman (2012), and Traxler and Brandl (2009). One open issue is the role of sectoral bargaining. While unions see it as a useful coordination device, labor economists often see it as counterproductive.

22The Wassenaar Agreement brought employer groups and labor unions together in an accord that reduced the growth of wages in combination with the initiation of policies to curb joblessness and bring down inflation. The agreement is considered to have broken the wage-price spiral, significantly boosting employment and economic growth. The Moncloa Pact was an agreement reached in 1977 between the Spanish government and delegates of political parties to set the basic shape of economic and social policy during the political transition; it is seen as democratic Spain's first social contract.

23Jimeno and Thomas (2013) show that, disregarding externalities and other strategic issues associated with the level of bargaining, "efficient" firm-level bargaining can be reproduced with sectoral agreements provided that opt-out clauses are operative.

24Table 1 in the Appendix provides a summary of the recommendations in IMF programs in advanced economies in Europe.

Full size table

25Dao and Loungani (2010) look at the human costs of this increase in unemployment.

26As we discuss below, changes in labor market institutions are useful over the medium run, and may lead to faster wage and price adjustment over the short run, but restoring aggregate demand is essential.

27Hobijn and Sahin (2012) find some evidence of shifts in only 4 of the 14 economies that they study (Portugal, Spain, Sweden, and the United Kingdom). Diamond (2013) explains why care is needed in interpreting these shifts; they may not reflect a higher natural rate of unemployment either now or later. The behavior of other measures of mismatch is described in Chen et al. (2011) and Lazear and Spletzer (2012).

28The behavior of inflation is analyzed in a chapter of the April 2013 World Economic Outlook (International Monetary Fund 2013a).

29International Monetary Fund (2013b) stresses the importance of improvements in intermediation: in many countries, near-zero or negative credit growth has been a main factor in the slow economic recovery.

30See Boeri and Bruecker (2011), Cahuc and Carcillo (2011) and Rinne and Zimmermann (2012).

31See Stovicek and Turrini (2012) for a detailed cross-country comparison of the features of the unemployment benefits systems in the EU.

32A joint report by International Labor Organization et al. (2012) for the G20 concludes that: "Maintaining the purchasing power of minimum wages at around 30 to 40 per cent of median wages sustains demand and reduces poverty and income inequalities. Statutory wage floors systematically set at levels significantly above that range entail the risk that these benefits would be more than offset by lost job opportunities, especially for youth and low-skilled workers. Allowing the minimum wage to slip significantly below that range risks exacerbating poverty while weakening demand" (p. 12). The IMF has also on occasion recommended an increase in the minimum wage, for example, in Lithuania in 2012.

33See Farhi et al. (2011) for a recent statement of the case for fiscal devaluation; and de Mooij and Keen (2012) for estimates of the potential impact. de Mooij and Keen stress that implementation of a fiscal devaluation requires many detailed choices that can "powerfully modify the impact of the tax shift" and hence a solution "which looks easy on paper" can be risky if not properly implemented.

34Using data for a panel of OECD countries and sectors over the 1984 to 2007 period, Bourlès et al. (2010) find that stringent product market regulations reduce total factor productivity in downstream industries. They estimate that aligning such regulations in upstream industries to best-practice levels would raise total factor productivity by ½ to 3½ percent over the next 5 years, and by 1½ to 10 percent over the next 10 years depending on the countries considered.

35See the discussion in Barkbu, Rahman, and Valdés (2012).

36The recommendations for countries in this paragraph and the next are contained in the paper on "Fiscal Policies and Employment in Advanced and Emerging Economies" produced by the Fiscal Affairs Department, International Monetary Fund (2012).

Appendix

The table (Table 1) below provides a summary of the recommendations in IMF programs in advanced economies in Europe.

References

-

Aghion P, Algan Y, Cahuc P: Civil Society and the State: the interplay between cooperation and minimum wage regulation. Journal of the European Economic Association 2011,9(1):3–42. 10.1111/j.1542-4774.2010.01004.x

Google Scholar

-

Akerlof GA, Yellen JL (Eds): Efficiency Wage Models of the Labor Market. Cambridge, United Kingdom: Cambridge University Press; 1987.

Google Scholar

-

Algan Y, Cahuc P: Civic virtue and labor market institutions. Am Econ J Macroecon 2009,1(1):111–145. 10.1257/mac.1.1.111

Google Scholar

-

Barkbu B, Rahman J, Valdés RO: "Fostering Growth in Europe Now", IMF Staff Discussion Note No. 12/07. Washington: International Monetary Fund; 2012.

Google Scholar

-

Bassanini A, Nunziata L, Venn D: Job protection legislation and productivity growth in OECD countries. Economic Policy 2009,24(58):349–402. 10.1111/j.1468-0327.2009.00221.x

Google Scholar

-

Bentolila S, Dolado JJ: Labour flexibility and wages: lessons from Spain. Economic Policy 1994,9(18):53–99. 10.2307/1344458

Google Scholar

-

Bertola G, Blau F, Kahn L: Labor market institutions and demographic employment patterns. Journal of Population Economics 2007,20(4):833–867. 10.1007/s00148-007-0137-8

Google Scholar

-

Bertola G, Boeri T, Nicoletti G (Eds): Welfare and Employment in a United Europe: A Study for the Fondazione Rodolfo DeBenedetti. Cambridge, Massachusetts: MIT Press; 2001.

Google Scholar

-

Betcherman G: "Labor Market Institutions: A Review of the Literature," World Bank Policy Research Working Paper No. 6276. Washington DC: World Bank; 2012.

Google Scholar

-

Blanchard O, Landier A: The perverse effects of partial labour market reform: fixed-term contracts in France. Economic Journal 2002,112(480):F214-F244.

Google Scholar

-

Blanchard O, Philippon T: "The Quality of Labor Relations and Unemployment," Stern School of Business, NYU Working Paper No. FIN-06–038. New York: New York University; 2006. http://ssrn.com/abstract=1293660

Google Scholar

-

Blanchard O, Portugal P: What hides behind an unemployment rate: comparing Portuguese and U.S. Labor Markets. American Economic Review 2001,91(1):187–207. 10.1257/aer.91.1.187

Google Scholar

-

Blanchard O, Tirole J: "The Optimal Design of Unemployment Insurance and Employment Protection. A First Pass". NBER Working Paper No. 10443. Cambridge, Massachusetts: National Bureau of Economic Research; 2004.

Google Scholar

-

Boeri T: Institutional reforms and dualism in European labor markets. Handbook of Labor Economics 2011, 4: 1173–1236.

Google Scholar

-

Boeri T, Bruecker H: Short‒time work benefits revisited: some lessons from the Great Recession. Economic Policy 2011,26(68):697–765. 10.1111/j.1468-0327.2011.271.x

Google Scholar

-

Boeri T, Garibaldi P: Beyond eurosclerosis. Economic Policy 2009,24(59):409–461. 10.1111/j.1468-0327.2009.00225.x

Google Scholar

-

Bourlès R, Cette G, Lopez J, Mairesse J, Nicoletti G: "Do Product Market Regulations in Upstream Sectors Curb Productivity Growth? Panel Data Evidence for OECD Countries", NBER Working Paper No. 16520. Cambridge, Massachusetts: National Bureau of Economic Research; 2010.

Google Scholar

-

Cahuc P, Carcillo S: "Is Short-Time Work a Good Method To Keep Unemployment Down?" IZA Discussion Paper No. 5430. Bonn: Institute for the Study of Labor; 2011.

Google Scholar

-

Cahuc P, Postel-Vinay F: Temporary jobs, employment protection and labor market performance. Labour Economics 2002,9(1):63–91. 10.1016/S0927-5371(01)00051-3

Google Scholar

-

Calmfors L, Driffill J: Bargaining structure, corporatism and macroeconomic performance. Economic Policy 1988,3(6):13–61. 10.2307/1344503

Google Scholar

-

Card D, Kluve J, Weber A: Active labour market policy evaluations: a meta-analysis. Economic Journal 2010,120(548):F452-F477. 10.1111/j.1468-0297.2010.02387.x

Google Scholar

-

Chen J, Kannan P, Loungani P, Trehan B: "New Evidence on Cyclical and Structural Sources of Unemployment", IMF Working Paper No. 11/106. Washington: International Monetary Fund; 2011.

Google Scholar

-

Dao M, Loungani P: "The Human Cost of Recessions: Assessing It, Reducing It", IMF Staff Position Note No. 10/17. Washington: International Monetary Fund; 2010.

Google Scholar

-

de Mooij R, Keen M: "'Fiscal Devaluation' and Fiscal Consolidation: The VAT in Troubled Times", NBER Working Paper No. 1793. Cambridge, Massachusetts: National Bureau of Economic Research; 2012.

Google Scholar

-

Diamond PA: Aggregate demand management in search equilibrium. Journal of Political Economy 1982,90(5):881–894. 10.1086/261099

Google Scholar

-

Diamond PA: Wage determination and efficiency in search equilibrium. Review of Economic Studies 1982,49(2):217–227. 10.2307/2297271

Google Scholar

-

Diamond PA: "Cyclical Unemployment, Structural Unemployment", NBER Working Paper No. 18761. Cambridge, Massachusetts: National Bureau of Economic Research; 2013.

Google Scholar

-

Doeringer PB, Piore MJ: Internal Labor Markets and Manpower Analysis. Armonk, New York: M.E. Sharpe; 1971.

Google Scholar

-

Dolado JJ, García‒Serrano C, Jimeno JF: Drawing lessons from the boom of temporary jobs in Spain. Economic Journal 2002,112(480):F270-F295. 10.1111/1468-0297.00048

Google Scholar

-

Elmeskov J, Martin JP, Scarpetta S: Key lessons for labour market reforms: evidence from OECD Countries' experience. Swedish Economic Policy Review 1998,5(2):205–252.

Google Scholar

-

Farhi E, Gopinath G, Itskhoki O: "Fiscal Devaluations", NBER Working Paper No. 17662. Cambridge, Massachusetts: National Bureau of Economic Research; 2011.

Google Scholar

-

Flanagan RJ: Macroeconomic performance and collective bargaining: an international perspective. Journal of Economic Literature 1999,37(3):1150–1175. 10.1257/jel.37.3.1150

Google Scholar

-

Gómez-Salvador R, Messina J, Vallanti G: Gross job flows and Institutions in Europe. Labour Economics 2004,11(4):469–485. 10.1016/j.labeco.2004.02.006

Google Scholar

-

Hobijn B, Sahin A: "Beveridge Curve Shifts across Countries Since the Great Recession", Working Paper No. 2012–24. San Francisco: Federal Bank of San Francisco; 2012.

Google Scholar

-

Ichino P: Inchiesta sul lavoro. Perché non dobbiamo avere paura di una grande riforma. Segrate, Italy: Mondadori; 2012.

Google Scholar

-

International Labor Organization: Boosting Jobs and Living Standards in G20 Countries. 2012. http://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/documents/publication/wcms_183705.pdf

Google Scholar

-

International Monetary Fund: Fiscal Policy and Employment in Advanced and Emerging Economies. Fiscal Affairs Department; 2012. http://www.imf.org/external/np/pp/eng/2012/061512.pdf

Google Scholar

-

International Monetary Fund: World Economic Outlook. Washington: World Economic and Financial Surveys; 2013.

Google Scholar

-

International Monetary Fund: Global Financial Stability Report. Washington DC: International Monetary Fund; 2013.

Google Scholar

-

Jimeno JF, Rodríguez-Palenzuela D: "Youth Unemployment in the OECD: Demographic Shifts, Labour Market Institutions, and Macroeconomic Shocks", Working Paper No. 155. Frankfurt: European Central Bank; 2002.

Google Scholar

-

Jimeno JF, Thomas C: Collective bargaining, firm heterogeneity and unemployment. European Economic Review 2013, 59: 63–79.

Google Scholar

-

Lazear EP, Spletzer JR: "The United States Labor Market: Status Quo or A New Normal?" NBER Working Paper No. 18386. Cambridge, Massachusetts: National Bureau of Economic Research; 2012.

Google Scholar

-

Martin JP, Scarpetta S: Setting it right: employment protection, labour reallocation and productivity. De Economist 2012,160(2):89–116. 10.1007/s10645-011-9177-2

Google Scholar

-

Mortensen DT, Pissarides CA: Job creation and job destruction in the theory of unemployment. Review of Economic Studies 1994,61(3):397–415. 10.2307/2297896

Google Scholar

-

Organisation for Economic Cooperation and Development (OECD): "Employment Protection Regulation and Labour Market Performance", OECD Employment Outlook 2014, Chapter 2. Paris: OECD Publishing; 2004:61–126.

Google Scholar

-

Organisation for Economic Cooperation and Development (OECD): OECD Employment Outlook 2006: Boosting Jobs and Incomes. Paris; 2006.

Google Scholar

-

Organisation for Economic Cooperation and Development (OECD): "More Jobs but Less Productive? The Impact of Labour Market Policies on Productivity," OECD Employment Outlook 2007, Chapter 2. Paris: OECD Publishing; 2007:55–103.

Google Scholar

-

Organisation for Economic Cooperation and Development (OECD): "Institutional and Policy Determinants of Labour Market Flows," OECD Employment Outlook 2010: Moving Beyond the Jobs Crisis, Chapter 3. Paris: OECD Publishing; 2010:167–210.

Google Scholar

-

Perez E, Yao Y: "Can Institutional Reform Reduce Job Destruction and Unemployment Duration? Yes It Can", IMF Working Paper No. 12/54. Washington: International Monetary Fund; 2012.

Google Scholar

-

Pissarides CA: Equilibrium Unemployment Theory. Cambridge, Massachusetts: MIT Press; 2000.

Google Scholar

-

Rinne U, Zimmermann K: "Another Economic Miracle? The German Labor Market and the Great Recession", IZA Discussion Paper No. 6250. Bonn: Institute for the Study of Labor; 2012.

Google Scholar

-

Scarpetta S: Assessing the role of labour market policies and institutional settings on unemployment: a cross-country study. OECD Economic Studies 1996,26(1):43–98.

Google Scholar

-

Schmitt J: Why Does the Minimum Wage Have No Discernible Effect on Employment?. Washington: Center for Economic and Policy Research; 2013.

Google Scholar

-

Stovicek K, Turrini A: "Benchmarking Unemployment Benefit in the EU", IZA Policy Papers No. 43. Bonn: Institute for the Study of Labor; 2012.

Google Scholar

-

Syverson C: What determines productivity? Journal of Economic Literature 2011,49(2):326–365. 10.1257/jel.49.2.326

Google Scholar

-

Traxler F, Brandl B: The Economic Effects of Collective Bargaining Coverage; A Cross-National Analysis. Geneva: International Labor Organization; 2009.

Google Scholar

Download references

Acknowledgment

We are grateful to David Autor, Peter Bakvis, Larry Ball, Tito Boeri, Sharan Burrow, Pierre Cahuc, Mai Dao, John Evans, Davide Furceri, Pietro Ichino, Juan Jimeno, Richard Layard, Stephen Nickell, Stephen Pursey, Antonio Spilimbergo, Alessandro Turrini, colleagues in IMF departments and IMF management for useful comments and suggestions. Chanpheng Fizzarotti and Jair Rodriguez provided outstanding research assistance. We thank colleagues in our Communications department and Shanti Karunaratne for editorial assistance. The views expressed in this study are the sole responsibility of the authors and should not be attributed to the International Monetary Fund, its Executive Board, or its management.

Responsible editor: Juan F Jimeno.

Additional information

Competing interests

The IZA Journal of Labor Policy is committed to the IZA Guiding Principles of Research Integrity. The authors declare that they have observed these principles.

Authors' original submitted files for images

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License ( https://creativecommons.org/licenses/by/2.0 ), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Reprints and Permissions

About this article

Cite this article

Blanchard, O.J., Jaumotte, F. & Loungani, P. Labor market policies and IMF advice in advanced economies during the Great Recession. IZA J Labor Policy 3, 2 (2014). https://doi.org/10.1186/2193-9004-3-2

Download citation

-

Received:

-

Accepted:

-

Published:

-

DOI : https://doi.org/10.1186/2193-9004-3-2

Keywords

- Unemployment

- Labor market institutions

- Great Recession

Section 1 Guided Reading and Review Labor Market Trends Answers

Source: https://izajolp.springeropen.com/articles/10.1186/2193-9004-3-2

0 Response to "Section 1 Guided Reading and Review Labor Market Trends Answers"

Post a Comment